Health Care Reform: The Individual Mandate

Under the Affordable Care Act, the individual mandate requires all citizens and legal residents of the United States to have “minimum essential coverage” insurance b y January 1, 2014. People who do not have qualified health insurance or government health plan, like Medicare or Medicaid, must obtain health insurance or pay a penalty tax called the “shared responsibility payment.”

People have “minimum essential coverage” if they have:

- Government-sponsored plan (i.e. Medicare, Medi-Cal)

- Employer-sponsored plan

- Individual plan

U.S.-issued expatriate plans provide minimum essential coverage for expatriate employees and their dependents regardless of where they are located in the world.

People can choose to buy health insurance “on-exchange” or “off-exchange” plans that open in 2014. Some people can also receive federal premium assistance on an exchange, depending on household income. NOTE: There is a specific Open Enrollment period for which individuals can apply for coverage on/off the exchange, and individuals can no longer enroll at any time throughout the year (as done in prior years to Health Care Reform).

If a person does not have minimum essential coverage, the IRS will collect a tax penalty from him/her. The monthly tax penalty is described as 1/12th of the greater of:

If a person does not have minimum essential coverage, the IRS will collect a tax penalty from him/her. The monthly tax penalty is described as 1/12th of the greater of:

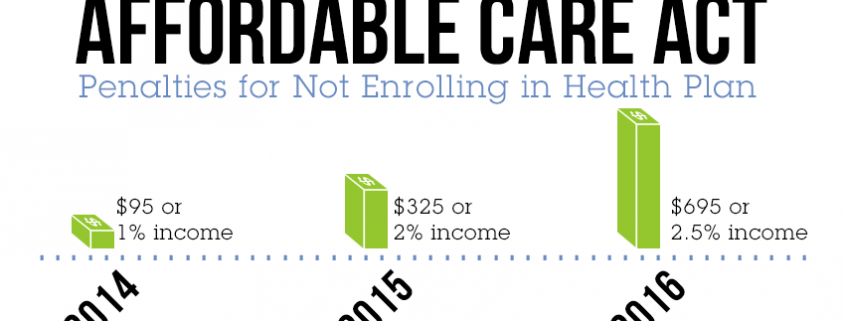

- For 2014: $95 per uninsured adult in the household (capped at $285 per household) or 1% of the household income over the filing threshold.

- For 2015: $325 per uninsured adult in the household (capped at $975 per household) or 2% of the household income over the filing threshold.

- For 2016: $695 per uninsured adult in the household (capped at $2,085 per household) or 2.5% of the household income over the filing threshold.

The penalty will be half of the amount for people under age 18. Beginning in 2017, the penalties will be increased by the cost-of-living adjustment.

There are a few exceptions to the penalty, including:

- Religious reasons,

- Not present in the United States,

- In prison,

- Not able to pay for coverage that is more than 8% of the household income,

- An income that is below 100% of the Federal Poverty Level,

- Having a hardship waiver, or

- Not covered for less than three months during the year.

See the following sites for more details:

The Requirement to Buy Coverage Under the ACA

IRS Individual Shared Responsibility Provision

This content is provided for informational purposes only. While we have attempted to provide current, accurate and clearly expressed information, this information is provided “as is” and MNJ Insurance Solutions makes no representations or warranties regarding its accuracy and completeness. The information provided should not be construed as legal or tax advice or as a recommendation of any kind. External users should seek professional advice form their own attorneys and tax and benefit plan advisers with respect to their individual circumstances and needs.