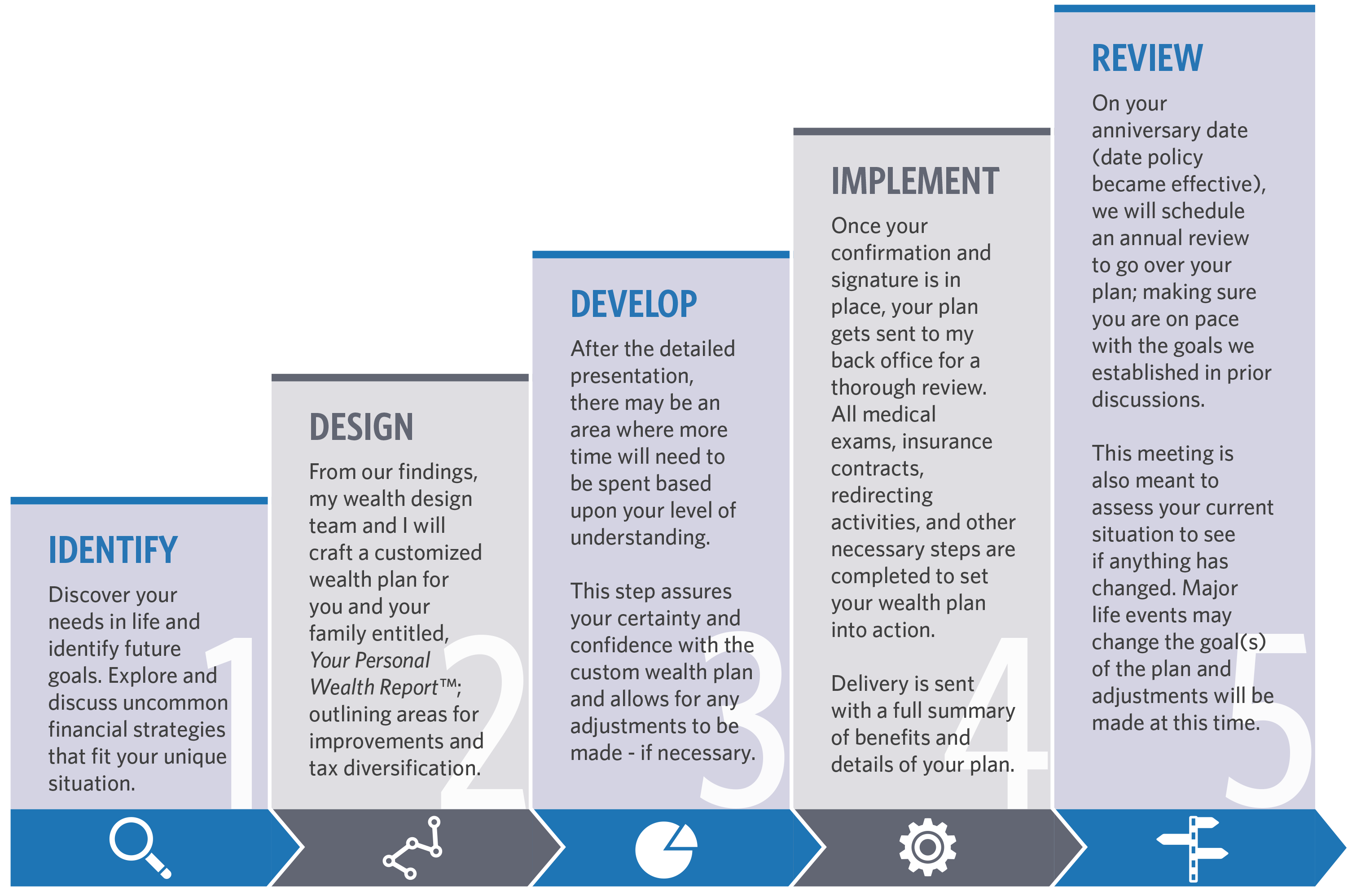

A five-step process designed for your unique situation

Life expectancy is increasing for the majority of Americans. According to IRS tables, the probability of at least one spouse of a couple who are 65 years old living to age 90 is at least fifty percent. Our lives will be very different in our golden years, but our need for cash for lifestyle expenses will still be there. It’s important that our money lasts at least as long as we do.

MNJ Insurance Solutions advises individuals, families, and businesses on ways to grow their money like the wealthy. Through our five-step process, we will explore the options currently available to you and build a custom wealth plan

designed for your unique situation.

Step 1: Identify

Discover your needs in life and identify future goals. Explore and discuss uncommon financial strategies

that fit your unique situation.

Step 2: Design

From our findings, my wealth design team and I will craft a customized wealth plan for you and your family entitled, Your Personal Wealth Report™; outlining areas for improvements and tax diversification.

Step 3: Develop

After the detailed presentation, there may be an area where more time will need to be spent based upon your level of understanding.

This step assures your certainty and confidence with the custom wealth plan and allows for any adjustments to be made – if necessary.

Step 4: Implement

Once your confirmation and signature is in place, your plan gets sent to my back office for a thorough review. All medical exams, insurance contracts, redirecting activities, and other necessary steps are completed to set your wealth plan into action.

Delivery is sent with a full summary of benefits and details of your plan.

Step 5: Review

On your anniversary date (date policy became effective), we will schedule an annual review to go over your plan; making sure you are on pace with the goals we established in prior discussions.

This meeting is also meant to assess your current situation to see if anything has changed. Major life events may change the goal(s) of the plan and adjustments will be made at this time.