Articles, News and Information

Understanding the Small Business Health Care Tax Credit for 2016

We receive many calls from clients and prospects regarding the Small Business Health Care Tax Credit, so we thought we would provide a brief summary for 2016. The Small Business Health Care Tax Credit is designed to encourage small businesses and small tax-exempt employers to offer health insurance coverage to their employees. In general,…

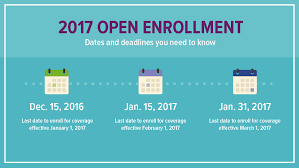

2017 Key Dates for Open Enrollment: Individual/Family Medical Plans

Did you know that in 2017 the Open Enrollment period is November 1, 2016 through January 31, 2017? Did you know that if you do not have qualified medical coverage, meeting the minimum essential benefits, that you may face a penalty for not having health insurance coverage, according to the ACA? (Note: there are a…

IRS Issued Notice 2016-4: Extending the Due Dates for Forms 1094-C and 1095-C for 2015

Great news for Applicable Large Employers (ALE) and self-insuring employers, who are required to report under Section 6055 and 6056 of the Internal Revenue Code. Per the IRS Notice 2016-4, they extended the deadlines for the 2015 Affordable Care Act (ACA) information requirements to complete the 2015 Forms 1094-C and 1095-C. Coverage providers also have…

Pay or Play? Reasons Why “Pay” is NOT the Easy Answer

“Pay or Play” Employer Mandate and Penalties (brief summary) Under the “Shared Responsibility of the Affordable Care Act (“ACA”), beginning January 1, 2015 employers with 100 or more full-time equivalent (“FTE”) working 30 hours or more per week (including the hours of the part-time workers added together to equal full-time equivalent workers) will be…

The PACE Act and What it Means to California Employers: October 2015

President Obama has signed into law the Protecting Affordable Coverage for Employees (PACE) Act. On September 28, 2015, the House of Representatives passed H.R. 1624 through voice vote and on October 1, the Senate passed the legislation through unanimous consent. How Will PACE Act Affect the Affordable Care Act (ACA)? Small group is currently…

Reporting Requirements for Applicable Large Employers: Section 6055 and 6056

The Affordable Care Act added Section 6055 and 6056 which requires Applicable Large Employers (ALEs) to file returns with the IRS and provide statements to their full-time employees regarding the health insurance coverage offered by the employer. For calendar year 2015, ALE must file the Section 6055 and 6056 returns on or before February 29…