Look beyond uncertainty as you prepare for retirement

How a fixed indexed annuity works

Two Unique Phases

Minimum Guaranteed Interest

Defer Paying Taxes

Phase One: Accumulation

The accumulation phase begins as soon as you purchase your annuity. Your annuity can earn a fixed rate of interest that is guaranteed by the insurance company or an interest rate based on the growth of an external index.

Phase Two: Distribution

The distribution phase of a fixed index annuity begins when you choose to receive income payments. You can always take income in the form of scheduled annuitization payments over a period of time, including your lifetime. And many fixed index annuities allow you to take income withdrawals as an alternative to annuitization payments.

Either way, you can choose from several different payout options based on your personal needs, including options for guaranteed lifetime income.

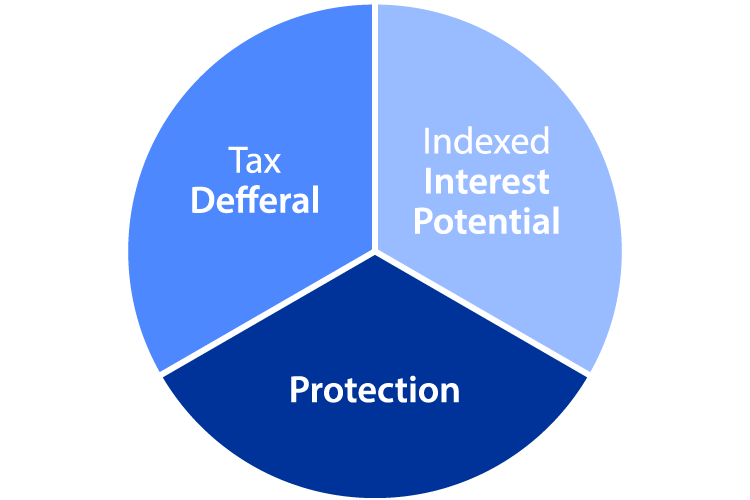

A unique combination of benefits that can help you achieve your long-term goals

Tax Deferral

Under current federal income tax law, any interest earned in your fixed index annuity contract is tax-deferred. You don’t have to pay ordinary income taxes on any taxable portion until you begin receiving money from your contract. Withdrawals are taxed as ordinary income and, if taken prior to age 59 1/2, a 10% federal additional tax may apply.

Indexed Interest Potential

Fixed index annuities provide an opportunity for potential interest growth based on changes in one or more indexes. Because of this potential indexed interest, FIAs provide a unique opportunity for accumulation. And since the interest your contract earns is tax-deferred, it may accumulate assets faster. In addition to potential indexed interest, FIAs can offer you an option to receive fixed interest.

Protection

Fixed index annuities offer you a level of protection you may find reassuring. That protection can benefit you in three separate ways:

Accumulation

Your principal and credited interest are protected against market downturns.

Guaranteed Income

You can be protected from the possibility of outliving your assets.

Death Benefit

If you pass away before annuity payments begin, a fixed index annuity may help you provide for your loved ones.