Small Group Rating on New ACA Plans Beginning in 2014

The Affordable Care Act (“ACA”) and new state laws great new rules for how small group health plan rates will be calculated in 2014 and beyond for small groups. These changes are different than how small group has been rated prior to ACA. For non-grandfathered small group plans, insurance must maintain a single risk pool for coverage in the small group market, and there will be no medical underwriting.

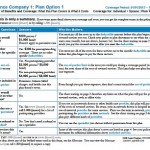

For grandfathered plans, rates in 2014 will be calculated using the same methodology used in 2013 (i.e. age bands, dependent coverage, etc.). For non-grandfathered plans, including “metal tier” plans available on and off-exchange, rates can vary based only on the following factors:

- Standard age curve: this age curve expands the number of age bands from 7 to 40 5H bands, requires all ensures to use the same age curve, and limits the oldest adult rate to no more than three times the youngest adult rate (defining adults as 21 and older).

- Family coverage: the cost of family coverage will be calculated by adding together the premium rate for each family member using the standard age curve. Insurance can charge no more than three oldest children under the age 21 per family. This approach to establishing family coverage is called the “member level rating,” as opposed to family to your rating, which is based on the employees age and family coverage category.

- Geographic area: rates can be higher for people who live in areas with high medical costs. The number of geographic right areas in California will jump from 9 to 19 into thousand 14, and they must be standardized across the insurers. In 2015, small group plans in California will be rated based on employer ZIP Code, whereas in the past, rates for most curious were based on employee home ZIP Code.

Example: Family with six children

| Dad, age 55 | Mom, age 52 | Child, age 24 | Child, age 20 | Child, age 17 | Child, age 14 | Child, age 10 | Child, age 5 |

Based on the medical plan selected, the new member level family rating would be calculated as follows:

Premium for dad, age 55, plus

Premium for mom, age 52, plus

Premium for child, age 24 (as family member’s age 21 and older are eight rated separately),

plus Premium for child, age 20,

plus Premium for child, age 17,

plus Premium for child, age 14 (as previously mentioned, insurance can charge for no more than the three oldest children under age 21 per family)

The additional children, age 10 and age 5, are not rated for this family’s premium.

Add each premium together and that is the new family rate under ACA for small groups.

NOTE: Birthday billing rates will adjust for age at contract renewal, along with the carriers trend increase for the small risk pool.

NOTE: As of January 1, 2016, small group rating will be for group sizes of 1-100, which will significantly change the 51-100 mid-sized employer’s rating and benefit offerings.

For more information, download Final Rule on Rate Review

MNJ Insurance Solutions can offer you affordable healthcare coverage for California employer groups of any size. Please contact us for a complementary quote from various insurance carriers at 714-716-4303.

This content is provided for informational purposes only. While we have attempted to provide current, accurate and clearly expressed information, this information is provided “as is” and MNJ Insurance Solutions makes no representations or warranties regarding its accuracy and completeness. The information provided should not be construed as legal or tax advice or as a recommendation of any kind. External users should seek professional advice form their own attorneys and tax and benefit plan advisers with respect to their individual circumstances and needs.